Money Dashboard Neon - Money & Budget Manager

Description of Money Dashboard Neon - Money & Budget Manager

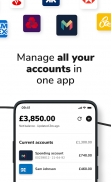

We help you avoid wasteful overdrafts, keep track of all your bills and subscriptions, and label all your transactions into helpful spend categories and budgets. Enabling you to save money with better visibility and control over your bank accounts and credit cards.

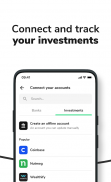

We take the hard work out of managing your money by safely and securely connecting directly with over 50 bank accounts, savings pots, credit cards and pension accounts. Get a clear view of how, when and where you spend your income, so you can ditch the budgeting spreadsheets, mental maths, and money calculators.

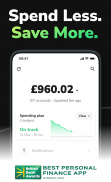

In less than 5 minutes, we'll show you how much you can safely spend until payday by calculating what's left after all your upcoming bills, subscriptions and scheduled payments. We automatically categorise all your transactions into helpful groups like Bills, Groceries, Expenses, Shopping, or Holidays. So you stick to your budgeting plan and reach your financial goals with ease.

- Connecting all your bank accounts in one app

- Labelling and categorising your purchases and transactions with custom categories

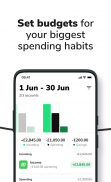

- Setup a personal budget for each category

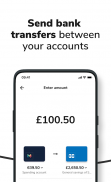

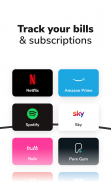

- Track and schedule your expenses, bills, subscriptions and other monthly payments

- Set up your pay cycle to track your income

- Use Money Dashboard across all your devices, budget on the go or at home

- Spend less and save more every month

- Avoid overdrafts or missed credit card payments with better visibility

- View, manage and cancel all your subscriptions, bills, and other scheduled payments

- See how much you have left to spend after bills, and set a realistic budget

The last thing you need is another subscription fee, which is why Money Dashboard is COMPLETELY FREE TO USE.

Best Personal Finance App, British Bank Awards 2021, 2020, 2018, 2017

FinTech of the Year, The Scottish Financial Technology Awards 2019

Best FinTech Collaboration, The Scottish Financial Technology Awards 2019

Best use of data science for good, fDATA Open Banking Awards 2019

Best innovation for savings journey, fDATA Open Banking Awards 2019

Most innovative new features as a force for making lives better, fDATA Open Banking Awards 2019

- We’ve been operating safely for 10 years, securely connecting to over 1.3 million accounts

- Our services are routinely inspected, tested and audited by qualified security and data specialists

- We are authorised and regulated by the Financial Conduct Authority, reg no. 800652

Money Dashboard connects to 50+ institutions including, but not limited to:

AIB (NI), Amazon, American Express (AMEX), Aqua Card, Bank of Scotland, Barclaycard, Barclays, Barclays Business, Barclays Corporate, Barclays Wealth, Burton Card, Capital One, Chelsea Building Society, Clydesdale, Cumberland Building Society, Coinbase, Danske Bank, Debenhams Card, Dorothy Perkins Card, Evans Card, First Direct, Fluid Card, Halifax, House of Fraser Card, HSBC, HSBC Business, Laura Ashley Card, Lloyds, M&S, Marbles Card, MBNA, Miss Selfridge Card, Monzo, Nationwide, Natwest, Nutmeg, Opus Card, Outfit Card, Pension Bee, Revolut, Royal Bank of Scotland (RBS), Sainsburys, Santander, Starling, Tesco, Topman Card, Topshop card, TSB, TUI Credit Card, Ulster Bank, Virgin Money, Wallis Card, Wealthify, Wise (Transferwise), WiseAlpha, Yorkshire Bank, Yorkshire Building Society.

Authorised and regulated by the Financial Conduct Authority (reg. 800652) & registered provider on openbanking.org.uk